What’s up with the oil market?

Last year’s collapse in the oil price has been well documented. We were unsurprised by the bounce and subsequent stabilisation in price over the first half of the year. However since June, the price has renewed its falls and tested the lows of December. Is demand faltering? Were the analysts at Goldman Sachs smoking something they shouldn’t when they issued a note saying oil could hit $20?

The word from Guinness Asset Management, who have honed a reputation in energy equities, is that weak prices reflect the supply situation as much as anything.

“The history of the oil price over its whole life has been dominated by two key factors. First, small imbalances of supply and demand can cause disproportionately large price fluctuations (because short run price elasticity of demand and supply is very low). But the second key factor is that these can be dampened by the behaviour of one or more large market participants if and when they decide to play a price management role. Standard Oil, the Texas Railroad Commission and the seven sisters have all played this role in the past. Most recently, from 1999-2014, it’s been OPEC who were happy to act as the swing producer.”

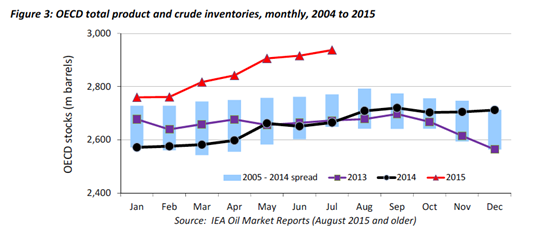

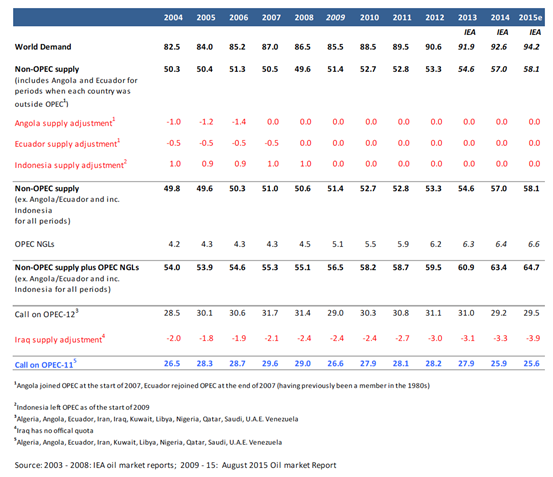

Note the 5mbpd leap in Non-OPEC production from 2013. The call on OPEC supply has fallen to under 30 mbpd this year. In fact OPEC-12 production is running at 32.3 mbpd. Unsurprisingly stocks are mounting.