The more I scream, the faster they go

Investment is a difficult discipline but there lies some very simple tenets at its heart. One of these is that the more you pay for an investment, the lower the return. As we approach the final stages of this long bull market, profits are approaching a cyclical peak and investors are paying a hefty multiple for these earnings.

It is common in late stages of bull runs for 'market darlings' to emerge. These stocks seemingly are impervious to rain or shine and behave magically as both performance drivers and havens for investors during market corrections. That is, until one day, they don't, often sounding the death knell for the bull market.

This cycle seems no different as once again tech stocks have taken the mantle as glamour stocks. Of the world's 10 largest listed companies, 6 are technology based (it seems a bit churlish to describe Amazon as a Consumer Discretionary as technically classed). Over 20% of the S&P 500's market cap is accounted for by technology businesses and the broader US whole market index is almost a quarter weighted in technology.

Rather sadly, the tech sector represents a whole 0.9% of the UK market. Things are not much better in Europe. The largest European tech company, SAP, is ranked a mere 73rd in the global index. Indeed, the market cap of the US FAANGs and Chinese BATs now exceeds the entire market cap of continental Europe.

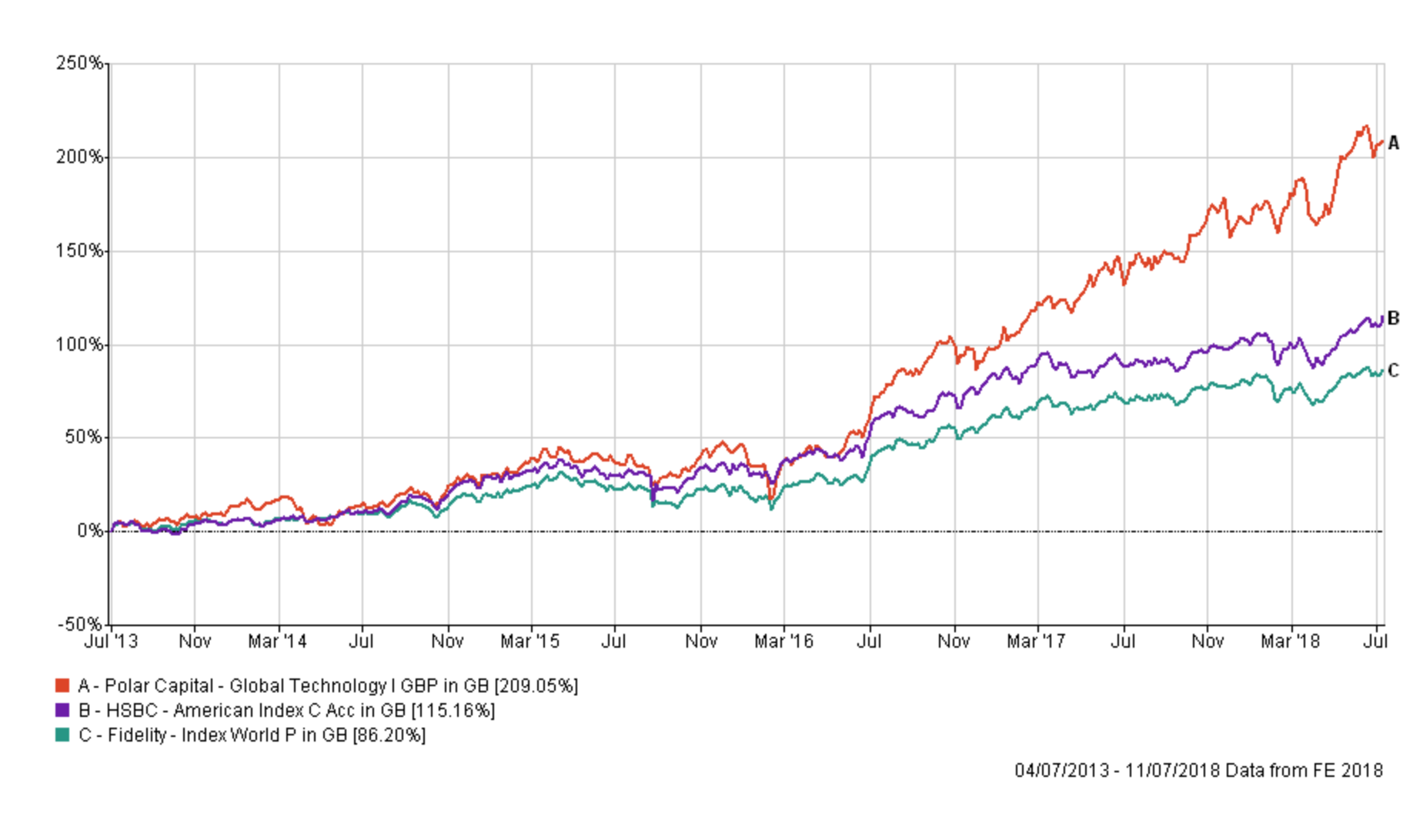

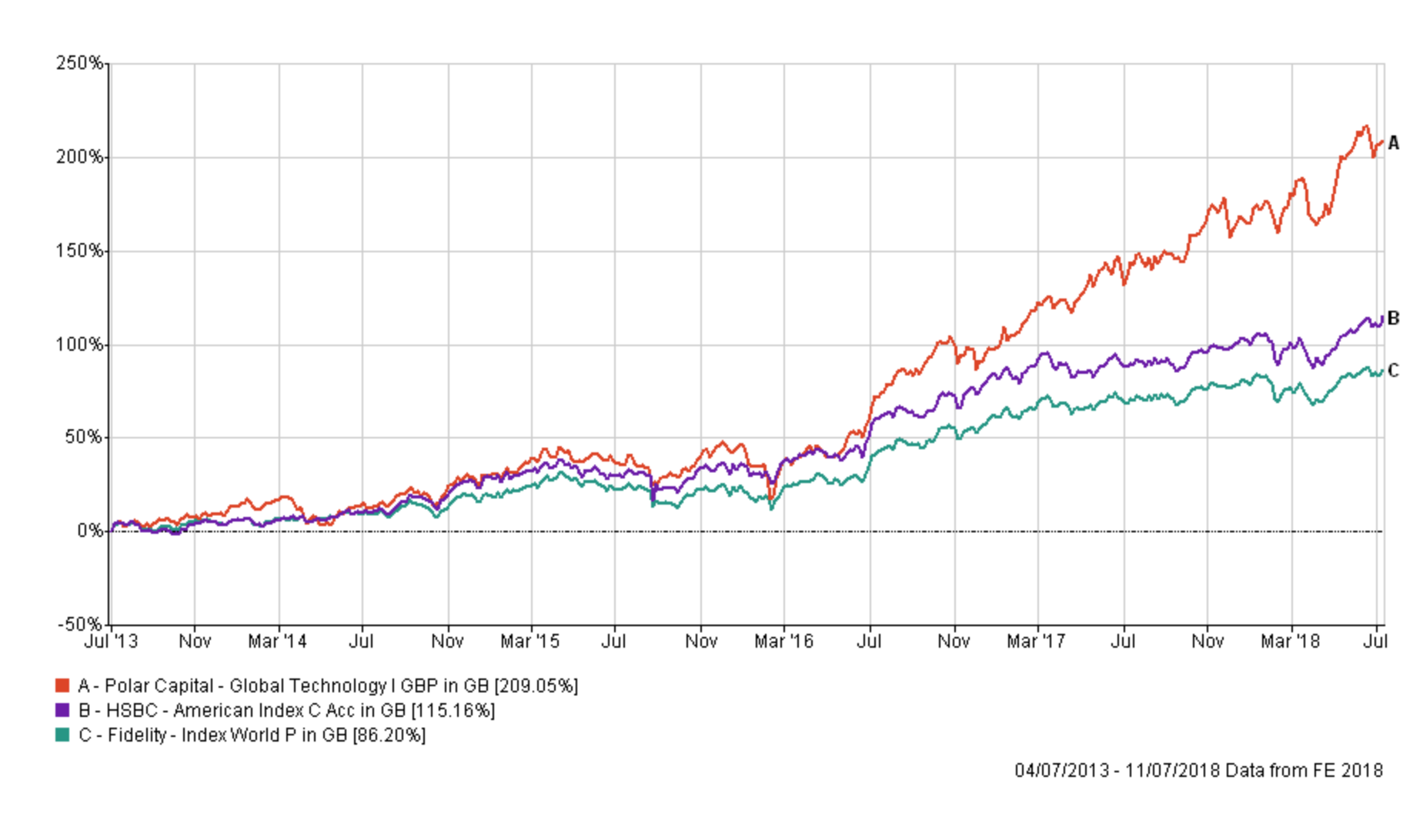

Tech has been outperforming for many years but in recent months it has been on a tear.

With the market caps of so many of these companies already deep into the stratosphere, how much longer can they drive market momentum?

It is common in late stages of bull runs for 'market darlings' to emerge. These stocks seemingly are impervious to rain or shine and behave magically as both performance drivers and havens for investors during market corrections. That is, until one day, they don't, often sounding the death knell for the bull market.

This cycle seems no different as once again tech stocks have taken the mantle as glamour stocks. Of the world's 10 largest listed companies, 6 are technology based (it seems a bit churlish to describe Amazon as a Consumer Discretionary as technically classed). Over 20% of the S&P 500's market cap is accounted for by technology businesses and the broader US whole market index is almost a quarter weighted in technology.

Rather sadly, the tech sector represents a whole 0.9% of the UK market. Things are not much better in Europe. The largest European tech company, SAP, is ranked a mere 73rd in the global index. Indeed, the market cap of the US FAANGs and Chinese BATs now exceeds the entire market cap of continental Europe.

Tech has been outperforming for many years but in recent months it has been on a tear.

With the market caps of so many of these companies already deep into the stratosphere, how much longer can they drive market momentum?