Hey Genius, You’re Worrying about the Wrong Deficit

The trade deficit dominates President Trump's attention and by some reports, he has been fixated on this subject since the late 80s when Japan seemingly threatened to take over the world. Clearly that episode did not end well for the Japanese economy, yet Trump has persisted in wailing about unfair trade practices with his main trading partners. To be fair, Trump's ultimate intention is to engineer freer trade is reasonable but is this really worth the risk of igniting a trade war to reset the balance?

Meanwhile there has been surprisingly little comment about the cost of his tax cuts. It may be more correct to consider these not as tax cuts but merely deferred taxation measures. Most of the personal cuts are earmarked to end by 2025 but even for the permanent corporate ones to be sustained, the money needs to come from somewhere. Otherwise it will necessitate cuts to expenditures. Trump reckons that the Laffer Curve will come to his rescue as the greater growth will lift tax revenues, but as this stage of the cycle this appears rather farfetched. Even using the fanciful assumptions in the White House projections, these tax cuts do not become self-funding over the next decade. While Trump believes that his policies will spur economic growth, there are good reasons to suspect that they won't.

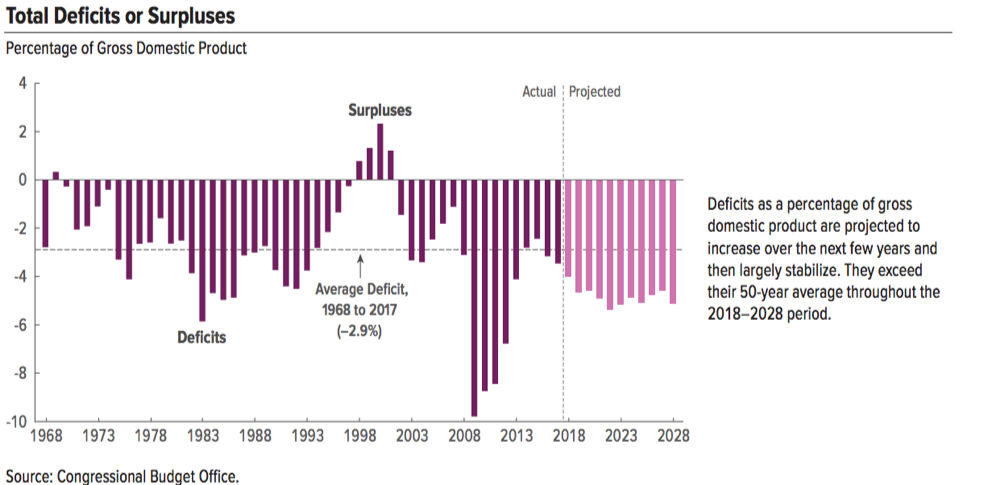

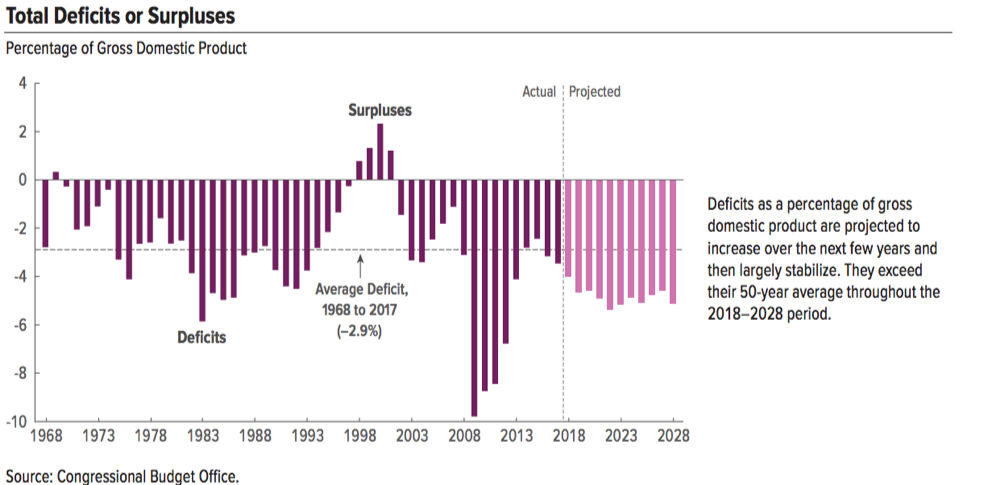

Looking at a more independent (and sober) assessment from the Congressional Budget Office, they predict no material increase in the growth rate over the long term. As a result tax cuts will swell the deficit to close to 6% of GDP by 2020 and persist at unhealthy levels thereafter. The Maastricht Treaty, which limits EU deficits to no more than 3%, of GDP puts this into perspective.

As I pointed out in one of my first posts, shortfalls in income over expenditure are far more pernicious for individuals than they are for governments. Mathematically, a deficit over the cycle equal to the nominal growth in the economy does not expand the national debt as a percentage of GDP. This provides a useful comfort blanket but will nominal US growth average anything like 6% over the coming decade? What happens if recession strikes? Trump, as with the trade war, is willing to take a massive gamble that this will work despite the perilous outcome if he is proved wrong.

To bring the deficit back towards the long term average 3% of GDP it will require a 3% structural reduction in the deficit. A 3% reduction in expenditure might sound trivial but let's remember that total government spending is not the same as GDP. US government outlays constitute only around 20% of GDP, the bulk of which is considered "mandatory" spending. This leaves ‘discretionary’ spending to absorb any cuts, and on paper it looks like spending here must be halved in order to bring the deficit to 3%. It is hardly credible that this would happen.

This brings us back to the notion that Trump's trumpeted tax cuts are a mere deferral in taxation. Yet the leap in the US stockmarket at the tail end of last year suggests that the market is assuming that this represents a permanent tax cut. If our fears are proved correct and a future Administration is forced to lift taxation, it must fall either on labour or capital. There must be a significant probability that a large part will fall on the latter. This is a problem for tomorrow but it would be unwise to forget this in any calculation of prospective US returns.

Meanwhile there has been surprisingly little comment about the cost of his tax cuts. It may be more correct to consider these not as tax cuts but merely deferred taxation measures. Most of the personal cuts are earmarked to end by 2025 but even for the permanent corporate ones to be sustained, the money needs to come from somewhere. Otherwise it will necessitate cuts to expenditures. Trump reckons that the Laffer Curve will come to his rescue as the greater growth will lift tax revenues, but as this stage of the cycle this appears rather farfetched. Even using the fanciful assumptions in the White House projections, these tax cuts do not become self-funding over the next decade. While Trump believes that his policies will spur economic growth, there are good reasons to suspect that they won't.

Looking at a more independent (and sober) assessment from the Congressional Budget Office, they predict no material increase in the growth rate over the long term. As a result tax cuts will swell the deficit to close to 6% of GDP by 2020 and persist at unhealthy levels thereafter. The Maastricht Treaty, which limits EU deficits to no more than 3%, of GDP puts this into perspective.

As I pointed out in one of my first posts, shortfalls in income over expenditure are far more pernicious for individuals than they are for governments. Mathematically, a deficit over the cycle equal to the nominal growth in the economy does not expand the national debt as a percentage of GDP. This provides a useful comfort blanket but will nominal US growth average anything like 6% over the coming decade? What happens if recession strikes? Trump, as with the trade war, is willing to take a massive gamble that this will work despite the perilous outcome if he is proved wrong.

To bring the deficit back towards the long term average 3% of GDP it will require a 3% structural reduction in the deficit. A 3% reduction in expenditure might sound trivial but let's remember that total government spending is not the same as GDP. US government outlays constitute only around 20% of GDP, the bulk of which is considered "mandatory" spending. This leaves ‘discretionary’ spending to absorb any cuts, and on paper it looks like spending here must be halved in order to bring the deficit to 3%. It is hardly credible that this would happen.

This brings us back to the notion that Trump's trumpeted tax cuts are a mere deferral in taxation. Yet the leap in the US stockmarket at the tail end of last year suggests that the market is assuming that this represents a permanent tax cut. If our fears are proved correct and a future Administration is forced to lift taxation, it must fall either on labour or capital. There must be a significant probability that a large part will fall on the latter. This is a problem for tomorrow but it would be unwise to forget this in any calculation of prospective US returns.