Large-cap stocks have been the darlings of the equity markets for a number of years now, with the Magnificent 7 reaching eye-watering capitalisations. Small-cap peers, in comparison, have received little love or attention from investors of late—to such an extent that many businesses in the space now have exceptionally cheap valuations. So, is the tide turning and is now the time to consider small cap opportunities?

Key takeaways

- Small caps have struggled against a difficult economic backdrop with high inflation, increasing interest rates and investor outflows.

- The difficult backdrop acted as a clearing event, leaving surviving small-cap companies stronger and more resilient.

- Small caps are less researched than large caps, offering active managers greater opportunity to identify undervalued, high-quality businesses.

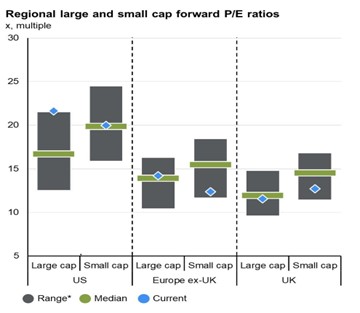

J.P. Morgan Asset Management recently released some research on the topic. In the following graph, they show that even though small caps typically trade at a higher valuation than large caps, recently, underperformance has eroded that usual valuation premium.

Past performance is not a guide to future returns.

Source: JPMorgan Asset Management - Guide to the Markets, November 2024. FactSet, IBES, LSEG Datastream, MSCI. Forward P/E ratio is price to 12-month forward earnings. All indices are MSCI. P/E ratios for small cap indices are as published by FactSet. Other P/E ratios are calculated using IBES earnings estimates. Range and median calculated from 2008 due to data availability. *Range is 10th to 90th percentile.

Large cap success

Large-cap companies are typically industry leaders with established market positions. They are often attractive to investors for their stability and reliability, producing consistent earnings.

Currently, some of the largest large-cap companies are the much-discussed Magnificent 7, with those aforementioned eye-watering capitalisations. They’re important to reference in any discussion about small-caps, given that Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla were responsible for the majority of returns in the S&P 500 in recent years. Even the shadow of concentration risk has done little to discourage investors. Primarily fuelled by robust earnings, the explosion of AI, and (arguably) market leadership in technology and innovation, these companies have thrived.

Importantly, they thrived against an incredibly tough backdrop too. Since the pandemic, inflation ran away from policymakers, resulting in a steep rate-hiking cycle. Yet, even though markets expected a global recession, growth remained—particularly in the U.S. Uncertainty from investors, who reacted to both good and bad news, manifested itself as volatility in the markets, encouraging investors to flee the small-cap space in favour of larger firms, less sensitive to swings in investment sentiment.

The challenges small caps faced

In contrast, small-cap stocks struggled to find their footing in the wake of the pandemic. Dogged by weaker balance sheets, limited pricing power, and increased sensitivity to economic slowdowns, these companies bore the brunt of tighter financial conditions.

Significant outflows from small-cap-focused funds exacerbated small-cap underperformance as investors moved to perceived safety. Fundamentally, too, the sheer dominance of large-cap growth stocks in market benchmarks overshadowed the opportunities within the small-cap universe - reinforcing the cycle of underperformance.

Looking to the small-cap future

Despite these recent challenges, there are a number of increasingly compelling reasons which may point to a far rosier future for small caps.

Firstly, the easing of monetary policy in many developed markets has (and will) bolster investor confidence. Easing monetary policy reduces companies' borrowing costs, lowers investment barriers, and therefore supports companies’ capacity to expand. Furthermore, inflation has slowed significantly. When inflation decreases it alleviates pressure on profit margins and can encourage consumer spending. As a result, the challenges that small caps have previously faced (higher interest rates and higher inflation) are now turning into tailwinds as policymakers cut rates and with inflation at its lowest since 2021.

Importantly, these economic difficulties of the last few years also acted as a clearing event. The companies that survived have emerged stronger, more resilient and more capable of capitalising on investment opportunities. As a result, these companies are subsequently far more compelling to outside investors, especially considering their relatively low valuations too.

Against this backdrop, active managers—especially in the small-cap space—could add a great deal of value. Unlike large caps, which are heavily researched by many analysts, small caps are less commonly appraised. Market inefficiencies therefore more commonly exist, leaving active investors with a greater chance of identifying high-quality, undervalued companies.

Square Mile and small caps

At Square Mile, we frame the importance of adapting to changing conditions with our long-term outlook. Moreover, our overall investment philosophy is rooted in identifying quality. To us, quality means investments with strong fundamentals and robust growth prospects for the future—whether it’s a fund with a bias to companies leading the S&P 500 or a fund that leans towards the smallest entities on the FTSE SmallCap index.

Investing in this way means we do not solely focus on one part of the market—rather, we ensure we are well-positioned and open to the very best long-term opportunities regardless of trends. So, should small caps emerge from years of underperformance the portfolios are well positioned to benefit and to help clients reach their investment outcomes. The impact of a rise in employers’ National Insurance contributions will also impact business differently. Businesses that are already under pressure may exit, while those with the strongest franchises will be better placed to absorb any costs that they cannot pass on. In this environment, stock selection will be vital in identifying the potential winners and losers.

Important Information

This document is marketing material issued and approved by Square Mile Investment Services Limited which is registered in England and Wales (08743370) and is authorised and regulated by the Financial Conduct Authority (FRN: 625562). Square Mile Investment Services Limited is a wholly owned subsidiary of Titan Wealth Holdings Limited (Registered Address: 101 Wigmore Street, London, W1U 1QU). This document is issued to professional advisers and regulated firms only and it is the responsibility of the professional adviser or regulated firm to determine if it is appropriate for this document (or any part of this document) to be provided to their underlying client base. It is published by, and remains the copyright of, Square Mile Investment Services Ltd (“SMIS”). SMIS makes no warranties or representations regarding the accuracy or completeness of the information contained herein. This information represents the views and forecasts of SMIS at the date of issue but may be subject to change without reference or notification to you. This document does not constitute investment advice, a recommendation regarding investments or financial advice in any way and shall not constitute a regulated activity for the purposes of the Financial Services and Markets Act 2000. This document shall not constitute or be deemed to constitute an invitation or inducement to any person to engage in investment activity. Should you undertake any investment activity based on information contained herein, you do so entirely at your own risk and SMIS shall have no liability whatsoever for any loss, damage, costs or expenses incurred or suffered by you as a result. SMIS does not accept any responsibility for errors, inaccuracies, omissions, or any inconsistencies herein. Unless indicated, all data supplied by LSEG Lipper (all rights reserved). Past performance is not a guide to future returns.